What is Bitcoin?

2.6 million jobs, and 10 million homes lost in the 2008 financial crisis in America. Many Americans and others around the world began to question the efficacy of the current financial system. Many people were upset and disenfranchised once they realized how bankers gamble with their money, they rig the game and play with your money. When they lose it, the taxpayer is left footing the bill. People were beginning to realize that the government and big money were colluding and cared not for the individual lives of the citizens.

Enter Bitcoin, Bitcoin was the first crypto currency to ever exist. Contrary to popular belief Bitcoin was not created in response to the housing market crash but instead the crash highlighted all of the pros that the Bitcoin community claim for the network. Created under the mysterious pseudonym Satoshi Nakamoto, Bitcoin was the world’s first decentralized peer to peer payments network. Bitcoin acts simultaneously as a payments network and a currency. It works based off of a potentially world changing technology named blockchain. I’m not going to explain what blockchain is here, maybe another time, also there are plenty of great recourses out there that can explain it much better that I. Suffice it to say that is is a very secure ledger essentially. Satoshi Nakamoto released the Bitcoin whitepaper in 2008 after the financial crisis, and mined the first genesis block in January 2009. Satoshi’s vision was to create a secure, peer to peer payments network that was completely decentralized. In theory this touts many benefits. Users would be able to send funds electronically to anyone around the world without any middleman for anything, no one would be able to control the network, all of the transactions would be securely recorded and immutable while also being anonymous. And as long as anyone can download and run the software the network could never die.

Hard-coded into the Bitcoin’s software is a maximum supply of 21,000,000 BTC. There will never be anymore or any less. This sounds great for many reasons. Namely that it would make Bitcoin disinflationary as opposed to inflationary like fiat currencies, meaning that since there is a static amount of Bitcoin that will ever exist there can be no inflation. Some people are confused and call it deflationary, deflationary would mean that over time there would be less Bitcoin supply. It creates scarcity which for some psychological reason makes people gotta have it. (I’m not producing anymore gamer boy bathwater, get some now before you miss out forever). You may have heard of Bitcoin in the 2017 massive crypto Bull-Run when all of the mainstream media was covering Bitcoin’s meteoric rise to over 19,000 USD per coin, or maybe more recently when Bitcoin broke past 20k, 30k, 40k, and 50k in recent months. While Bitcoin did succeed in being a secure, decentralized, and peer to peer digital cash at first, a few key issues began to surface.

Bitcoin Is Slow

Bitcoin works off of a concept called PoW or Proof of Work. How it works is the network is made up of individual computers (nodes or miners) that use their computational power in order to validate transactions on the network. The computational power from these miners is essentially used to attempt to guess the 256 bit value of a hash through complex mathematics, the guess must be less than or equal to the target hash. When users make transactions their transaction is queued in a pool, the miners then take some of the transactions from this pool and begin to form a block (completed series of transactions) to add to the blockchain. The computer that solves their block first then uploads their completed block to the blockchain, thus the name blockchain. Whichever computer solves the problem first gets a reward (which led to pooling, combining computers to share rewards), the reward is the incentive to contribute to the network, this reward is paid in Bitcoin. The whole system is supposed to mimic the difficulty of gold-mining which is one of the reasons gold is so valuable.

Now what happens to the blocks that all the other computers were building? These computers are forced to discard all of their hard work in favor of the computer that solved the block first. The blockchain records all of these blocks and they are forever part of the blockchain and cannot be changed due to some clever coding. Each block contains traces of the previous block, which allows people to audit the blockchain.

This was a revolutionary concept, but like all nascent technologies it has its drawbacks. Because of the way PoW is designed, Bitcoin is slow, very slow, it has to be slow by design to maintain security. The nodes in the network need to validate the new blocks added to the chain, this supposedly takes about 10 minutes for the network to reach consensus. If the network is sped up then the chances of an accidental hard fork increase. These accidental Hard Forks can happen when multiple computers say that they solved the problem and are trying to upload their block to the blockchain, creating a discrepancy within the network, so the network splits off into other new blockchains . So the Bitcoin network increases the mining difficulty in order to slow the transaction speed to avoid all the computers saying they solved the block and all uploading their block creating hundreds or thousands of new blockchains in quick succession. Keep in mind some forks are on purpose, but they function way differently. Say a part of the network wants to make changes to the protocol, they will update the blockchain software and start a new blockchain while the legacy blockchain remains. some are soft forks which are supposed to be beneficial for both chains.

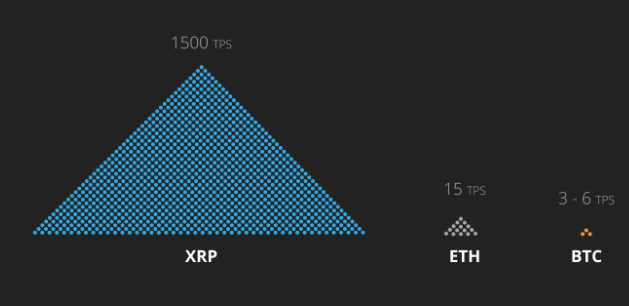

So in order to maintain a secure network Bitcoin only processes about 6 TPS(transactions per second). Visa is currently capable of 1,700 TPS, given this fact, I struggle to understand how so many Bitcoin Maximalists are so insistent that Bitcoin will be the future world money. How? When BTC is slower than legacy financial systems? There are ways to speed up the network but speeding up the network creates more problems, namely the Lightning Network. But we will get into that can of worms in a bit.

Bitcoin Is Centralized

Bitcoin is centralised. Bitcoin’s network is made up of miners as we discussed in my breakdown of PoW protocols. In theory the idea that any old Joe Shmoe can download the Bitcoin Blockchain software and begin contributing to the network is awesome and it sounds like it would be a decentralised power to the people revolution type thing. Except for the giant gaping hole drippy drop problems with PoW.

We’ll begin with halving. Every 210,000 blocks or approximately 4 years the Bitcoin network goes through a process called halving, basically the rewards for solving a block are reduced by ½ and the difficulty of the algorithms utilised to solve the blocks are increased, though if the value of Bitcoin is not enough to incentivise the miners to contribute to the network, the difficulty is decreased, kind of like Skill-Based Matchmaking in online video games. But what determines if the BTC reward is enough incentive for miners to contribute to the network? The computational power to run Bitcoin’s PoW network is immense, to run these computers takes energy and a lot of it. As you know if you are a bill paying adult, power costs money, so these miners need to make enough money to pay their bills and still stay in profit. The harder the algorithms the miners solve, the higher the costs to run. Pretty simple, and also pretty expensive, energy intensive, and many (to include myself) would say wasteful. The reason that the mining has to be difficult relates back to network consensus. The Bitcoin network adds a new block to the blockchain every 10 minutes, which gives the network nodes enough time to validate the new block to prevent accidental hard forking. If the network is taking too long to mine and validate new blocks, then the hashing algorithms ease up a bit in terms of difficulty. So put simply if the network is too slow the algorithm eases, if it’s too fast it becomes more difficult. Because of this design, Bitcoin now consumes more power than Switzerland, and in an era where much of the world and powers that be are focused on climate change and going green, it’s hard to believe that society would embrace such a wasteful enterprise, especially when there are projects that accomplish the same thing but in a better way.

Satoshi clearly did not foresee that over time his PoW protocol would inevitably lead to the centralization of the network. Because of the nature of BTC mining (incentivizing the monopoly of hash-power) miners flock to areas that have cheap electricity costs, like China. China’s share of the Bitcoin network has ranged over the years from 50-80% of the total network. The problem here is that Bitcoin is susceptible to a 51% attack. A 51% attack is when a miner (or pool of miners) controls 51% or more of the network. If a miner or group of miners control 51% or more of the network, once they complete a block, they can decline to upload their block to the rest of the network (so the network continues without knowing about the new block) and instead, run their own private blockchain alongside the original. And since they have 51% or more of the mining power they can mine blocks faster than the original blockchain network. This is important because when the attacker finally decides to upload their blockchain to the network the network will accept the longest chain as the true chain( even if it’s not :0). This means that in theory whoever is conducting this 51% attack can double spend.

But why? Why would anyone do this? It would destroy the network! Yes a 51% attack would render Bitcoin valueless not only due to the fake Bitcoin that had been spent but also because no one would trust the network any longer. Some Bitcoin lover’s will try to explain why no one would ever do this because you can only do it once and after that the network is destroyed. Kind of like how someone can only rob you of all of your stuff once because after they rob you you don’t have stuff anymore so why would anyone DO THAT. Besides the fact that it doesn’t even MATTER if anyone WOULD do it, its that they COULD. How does anyone trust this network?

Let’s say the Chinese Communist Party decides to do something evil and awful (I know, completely unlikely and totally irrational) such as buy supplies for a metric fuck ton of nukes with the Bitcoin supply they got from forcing their miners to 51% the network.

Not very good I’d say, not a real big fan here. Many Bitcoin maximalists would say that this can’t happen because Bitcoin is decentralized, and then ignore you when you explain how its not. Or they may deny that the CCP would ever be able to control their miners. Just like they don’t control what their people see on the internet, and just like they don’t put Uyghurs in concentration camps, and just like they don’t use surveillance and social engineering to control the behavior of their population, and the list goes on. Some people are so afraid to let go of what they thought was the best thing to ever happen to finance, some people are so afraid of having to change their perspective, some people are just afraid to be wrong, and others are afraid that their massive holding of BTC would go to zero if the truth was known by the masses. How then would they dump their bags of BTC on you? Cause they’re certainly never going to be able to transact efficiently with BTC, so why even hold it?

Which brings us to another point. Bitcoin is supposed to be this financial revolution, anti-bank and anti-centralization yet 4.11% of wallets own 96.53% of ALL OF THE BITCOIN. And not to mention that most holders of any crypto have multiple wallets, meaning that the number of individuals that control 96.53% of all of the Bitcoin could be even less 4.11% of all holders. Yikes. So much for sticking it to the elites. And not to mention the every Bitcoin Maxi’s hero Satoshi Nakamoto mined 1 million Bitcoins before releasing the network to the public… Wow!

China is also the leading producer of ASIC miners. ASIC miners or Application Specific Integrated Circuits are the hardware that Bitcoin miners need to use to mine Bitcoin. They need to use ASICs because of the extreme difficulty of Bitcoin mining. This isn’t necessarily bad in and of itself but it is important to note. More important is the fact that because of the need for ASICs, the average Joe Shmoe is priced out of mining Bitcoin, further centralizing the mining power of the network to the big fish. The top end ASICs currently go for $3,000 a pop, large Bitcoin mining farms can have thousands of these ASICs. Furthermore, given current residential internet speeds and the ever increasing size of the Bitcoin blockchain, Joe Shmoe may NEVER be able to download the blockchain in order to run his/ her own miners due to modern day internet speeds. Sidenote, since Bitcoin is not used as a commonly accepted currency, these miners have to sell their Bitcoin on the open market in order to actually pay for anything. So all the money that hard working investors are pouring into Bitcoin, is simultaneously going right back out to fund the whole operation.

I read a book called Life After Google, at first it seemed really intelligent, the author, George Gilder is a huge fan of Bitcoin, he even addresses some of Bitcoin’s current issues in his book. But instead of realizing that Satoshi Nakamoto is not God and probably doesn’t hold the key to all knowledge in his pocket, he instead fantasizes that there must be some genius at play here that we all just can’t comprehend when mulling over how bad PoW sucks monkey balls. I think it’s much more probable that like any revolutionary technology, the first edition turns out to be more of a proof of concept than a reliable option.

Bitcoin Is Expensive

Because of the nature of proof of work, in that miners need incentives to mine, and since the network is slow there’s a backlog of transactions, which means that whoever is willing to pay the most fees gets their transaction validated first, which means that as the network increases in size and become more backlogged transaction fees rise. The average transaction fee right now is 14.86 USD worth of Bitcoin, if you want your transaction processed faster, you can opt to pay more, if you don’t mind waiting one to three days for your transaction to process you can go with a lower fee. So much for buying a coffee with Bitcoin.

Bitcoin – A greater fool’s investment

Bitcoin has been referred to as a greater fool’s investment. Namely by Bill Gates, Meaning that in order for your BTC to appreciate in value some poor sap has to buy in after you at a higher price, sort of like a pyramid. BTC has no utility, not even store of value, at least gold is used in electronics and you can hold it in your hand. In the words of Mark Cuban “I’d rather have bananas than Bitcoin” though I think now he is growing fond of the digital asset space. You’ll often hear if you are in the crypto space, people tell you buy and hold, but many times those people are selling their bitcoin during the bull runs. Now any good investor should not feel bad taking profits, but if you really believed in the utility and future of Bitcoin, would you really be selling it off? Especially if you are one of the Bitcoin shills who speaks about Bitcoin as if it’s the future of money. This often leaves the rookie crypto investor who is just maybe looking for an inflation hedge, or a good store of value, who was told that Bitcoin is a great investment and it’s definitely not centralized and can totally scale to become a legit payments network, holding the bag of those who sell their beloved coins. These activities are a large reason why most people are hesitant to enter the crypto space, it gives us all a bad name and yes I know this happens with every crypto but at least most of those boast some sort of utility, the foundation for a solid long term investment in crypto, as opposed to “Buy Bitcoin so it go up and green candle pretty”. Personally, if you couldn’t tell from reading this, in an asset class that is currently entirely speculative, I rely on sound fundamental analysis to decide what projects to invest in long term, and Bitcoins fundamental analysis is looking sorry.

The Lightning Network

The Lightning Network, or just LN (Lightning Network) is supposed to be the silver bullet to all of Bitcoin’s problems. Everything I’ve mentioned previously is supposed to be rendered mute by this revolutionary layer 2 option.

Lightning Network is a proposed layer 2 solution to BTC’s scaling problem, it aims to speed up transaction times to be capable of millions to billions of transactions per second. Pretty freaking fast and a bold claim. It also boasts low costs and cross-blockchain capabilities. Let’s investigate these claims.

LN was first proposed by Joseph Poon (lol) and Thaddeus Dryja (Dryja Poon is a great firm name) in 2015 (today is Feb 5 2021) and has been in development since then. How it’s supposed to work is the payer and payee set up a payment channel with each other that allows LN to use smart contract functionality to allocate Bitcoins to a multi-signature address. It works sort of like a safe in which both parties need to agree (sign) upon the amount of Bitcoin to be allocated. For instance if Joe wanted to buy his morning coffee with BTC, he would set up a payment channel with his coffee shop. Setting up payment channels and depositing funds happens on the actual Bitcoin blockchain. Then both parties agree on how much of the Bitcoin that is allocated to the multi-sig address (using smart contracts) will then be allocated to the coffee shop. So lets say Joe goes to this coffee shop every morning so he budgets a month’s supply of BTC to this address. When joe “signs” his part of the smart contract, he can determine how much of that total balance in the multi-signature address will go to the coffee shop in this particular transaction and the coffee shop must agree on the transaction total. After the contract is complete, the remaining balance of Bitcoin has to be processed as a payment to Joe’s own wallet on the blockchain and the Bitcoin that was allocated to the coffee shop also is processed as a payment on the blockchain.. Either party can cancel at any time and funds will be processed on the blockchain as delegated by the smart contract.

So, let’s see if we can point out the problems here. The first and most obvious issue is that it still is not widely adopted because it is still unproven tech. It is being used for some transactions currently, but is yet to be used in scale. Another issue is that you need to open payment channels with everyone you want to pay, they say you don’t need to do that because the network tries to use payment channels that you have with certain entities to connect to other entities but when a payment channel that belongs to someone else is used, they are able to charge you a fee, creating more centralization and friction. I know that is more of a small quality of life issue but people and money follow the path of least resistance, if you want this network to be adopted it has to be as smooth as a baby’s bottom. Or a Bitcoin Maxi’s brain.

Lightning Network is vulnerable to security threats, while your Bitcoin is not on the blockchain a clever hacker can make your Bitcoin his/her Bitcoin. This is because the way they move Bitcoin on the network is akin to how data moves on the internet. There are still some transaction failures on the network which defeats one of the benefits of the blockchain. 10% of the LN nodes hold 80% of all the BTC on the network, making it more susceptible to attacks. Not to mention that until each contract is settled, you don’t have access to those funds for any other purpose than paying that merchant, and the merchant doesn’t see that money until the contract is settled and processed on the network. Yes you can cancel the contract, but then you’ll end up paying network fees to process sending your money back to your own wallet. DUMB.

All in all, having a layer 2 application to maybe kind of fix some of Bitcoins issues really undermines the whole point of a peer to peer, secure, decentralized blockchain. And again, why put all this effort putting lipstick on a pig when there are perfectly suitable options already? If we could make it work does that mean we should? In the end even if the Lightning Network fixes payment speeds, somehow addresses their security and centralization issues, that still doesn’t address that Bitcoin is already centralized by virtue of being PoW, and all these transactions still eventually have to be processed on the blockchain anyways.

I will grant that if somehow LN is able to alleviate the Bitcoin network of too much traffic, address all of it’s issues, be decentralized, and the Bitcoin network somehow keeps up with an entire planet’s worth of transactions without becoming too backlogged, and people don’t care that they won’t have as much active purchasing power because Bitcoin is still slow and LN hordes funds, and the world ignores that massive environmental hazard that is Bitcoin, and no one cares about how much friction there is, and we all forget that China has most of the mining power, and we haven’t already switched to something that actually already works by the time all that happens, then maybe Bitcoin would be used as money… Except… QUANTUM COMPUTING POSES A HUGE RISK TO BITCOIN’S SECURITY… I’ll save that can of worms for another day.

Sources https://docs.google.com/document/d/1YhxZUHaeQGuyW0FmH76RjouhCl9hjsscKVnmJNfkrr0/edit?usp=sharing